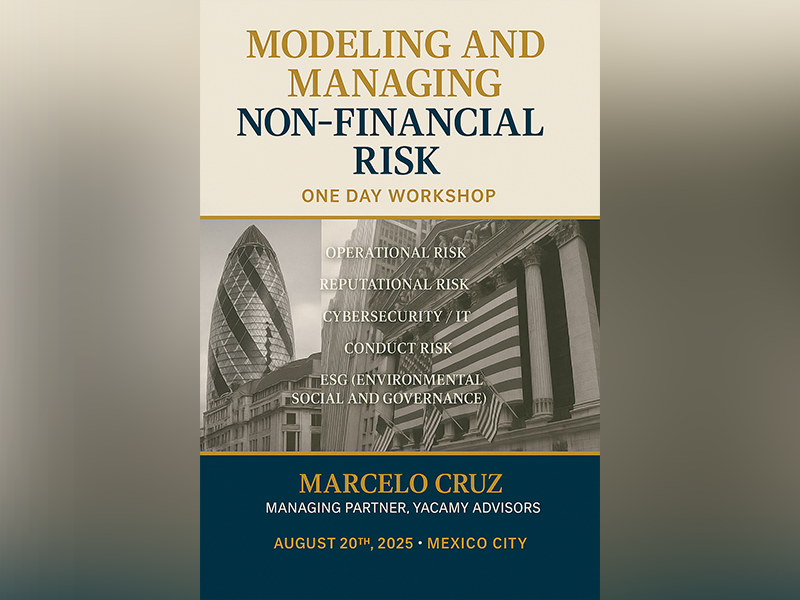

Modeling and Managing non Financial Risks

Non-financial risk refers to any type of risk that does not directly involve a loss of money through traditional market, credit, or liquidity channels. Instead, it encompasses a wide range of operational, legal, compliance, strategic and reputational issues that can impact an organization’s performance, integrity, or long-term viability.

Most of these non-financial risks are covered under operational risk and, as an example, these are:

Key Types of Non-Financial Risk

• Operational Risk: Failures due to internal processes, systems, human errors, or external events (e.g. IT system failures, fraud, natural disasters).

• Compliance Risk: Risk of violating laws, regulations, or internal policies.

• Legal Risk: Exposure to lawsuits, legal disputes, or contract failures.

• Reputational Risk: Damage to a company’s brand or public image due to negative publicity, scandals, or poor customer experience.

• Cybersecurity/IT Risk: Threats related to data breaches, hacki

7

1

2025-08-20

Mier

Descripción

This workshop aims at showing how analytical techniques are being used currently by financial institutions to assess their control environment and model and measure nonfinancial risk.

The seminar will be accessible to everyone, even those less educated in mathematics/ statistics as these concepts will be explained in a qualitative way as well.

Dirigido a:

Risk or data analytics professionals that want to learn how non-financial risk is modeled and measured in financial institutions. Any banking or insurance analyst that would like to understand how mathematical techniques are used in financial institutions. Governance, Risk and Compliance (GRC) officers that would like to see the latest on how banks use these programs to assess the control environment like Change Management Programs; Risk Control Self-Assessments (RCSA), etc.

The Latest From The Best

Conoce a nuestro profesorado